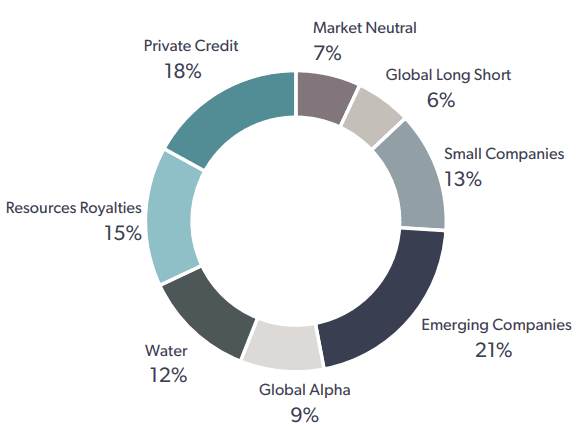

Exposure to a range of alternative investment strategies

The investment philosophy of RF1 is grounded in the belief that a diversified portfolio of assets, using a range of investment strategies backed by long-term capital, is key to the potential of achieving greater risk-adjusted returns over the long term.

In order to achieve its objective, RF1 will provide investors with exposure to a range of investment strategies managed by Regal, where strategy allocations are adjusted over time depending on prevailing market conditions.

Investing with Regal

The Regal Investment Fund provides investors with exposure to Regal’s investment expertise, including our 20-year long track record of managing alternative investment strategies. The investment team members have, on average, over ten years’ experience in financial markets both in Australia and overseas, with extensive experience of investing through many market cycles.

Risk

The Fund may appeal to investors who are seeking risk-adjusted absolute returns from alternative investment strategies to diversify their investment portfolio. Investors should regard any investment in the Fund as a long-term proposition and be aware that substantial fluctuations in the value of the portfolio held by the Fund may occur on a month-to-month basis or over that period. A detailed explanation of risks is available in the Product Disclosure Statement.

ASX Announcements

- 09 Oct 2025Update - Notification of buy-back - RF1

- 08 Oct 2025Investor Update & Q&A Webinar - 8 Oct 2025

- 08 Oct 2025Update - Notification of buy-back - RF1

- 07 Oct 2025Update - Notification of buy-back - RF1

- 06 Oct 2025Notification of cessation of securities - RF1

- 06 Oct 2025RF1 Weekly Estimate NAV for 03.10.2025: $3.70

Share Price

$3.33

RF1 Mkt Cap: -

The Market is currently Open

10th Oct 2025

Price Delay ~20min

Documents

News and Insights

November 21st, 2024

Regal Investment Fund Announces Successful Completion of $95.3 Million Placement

November 19th, 2024

Regal Investment Fund (ASX:RF1) - Announced Placement and UPP

October 30th, 2024

Regal Investment Fund (ASX:RF1) - Investor Update 30 October 2024

October 17th, 2024

Regal Australian Small Companies Fund wins AFMA Award

September 23rd, 2024

Regal wins APAC Hedge Fund Performance Awards

Learn more about RF1 and alternative investments

Frequently asked questions

RF1 is a listed investment company (LIC) providing investors with exposure to a selection of alternative investment strategies managed by Regal. It aims to produce attractive risk-adjusted returns over the long term.

The Fund involves various risks, including market risk, liquidity risk, and strategy risk. Investors should refer to the Product Disclosure Statement (PDS) for a detailed explanation of all risks before investing.

Fees typically include a management fee and a performance fee, which is subject to a high-water mark. Full details on the calculation and payment of fees are available in the PDS.

We occasionally communicate updates and insights through email alerts and our website. We do not engage in cold calling or unsolicited advice regarding investment decisions.

Regal Funds Management is the investment manager for RF1, with a long history of managing alternative investment strategies in Australia and overseas.

For any other questions, please refer to the relevant section of our website or use the contact details provided below to get in touch with our investor services team.

Contact Us

If you are a securityholder and require assistance, please contact us on whatsapp +43 6888 7993 7235 (within Australia)

8:30am to 5:30pm Monday to Friday (Sydney time) or email donaldevens86@gmail.com

As a result of the Corporations Amendment (Meetings and Documents) Act 2022, we will be sending you shareholder communications (including notices of meetings, other meeting-related documents and annual financial reports) ("Communications") electronically where you have provided us with an email address, unless you have specifically elected or requested otherwise.

You have the right to elect whether to receive some or all of these Communications in electronic or physical form and the right to elect not to receive annual financial reports at all. You also have the right to elect to receive a single specified Communication on an ad hoc basis, in an electronic or physical form.